Most of the professionals are following the cashless transaction and likewise the fuel industry is also doing the same. The payment through mobile is giving a fast and secure transaction to the customer. Also now it is safe to use such transactions to avoid the spreading of virus-like COVID 19. But petrol pumps don’t allow using mobile phones. It can lead to spark and other mishaps. So, a cashless payment solution for petrol pumps is a major concern.

Oil industries are claiming that they are following all the safety measures. Many of the customers confuse using the mobile wallet for fuel retails at the petrol pump. For this reason, some customers like to pay the payment through cash.

Well, to use the mobile inside the petrol pump there are rules which are as follows.

The petroleum rules 2002 lay down the norms for public protection from the danger which can come from transport, import, and production. As per rule 103, the hazardous area is defined as

- The presence of Inflammable gas or vapour in a concentration that is capable of ignition or petroleum which has flash point below 650C

- The inflammable liquid has a flashpoint above 650 C which is likely to blend, handle or storage above its flashpoint.

Rule 104 further classifies hazardous areas into three types:

- Zone 0 area: If the inflammable vapour or gas is expected to be present in the area.

- Zone 1 area: If the inflammable gas or vapour is present in the normal condition.

Zone 2 area:

- If the inflammable vapour or gas is present in the area under abnormal operating conditions.

Extend of these zones are as follows:

- Zone 0: It is the underground tank where the fuel is stored.

- Zone 1: The area which is 1.2 meters vertical above the base and 45 cm horizontally in all directions.

- Zone 2: It is the area between 45 cm and 6 meters of the cabinet extending 45 cms vertically above the grade level.

As per the Government rules, there is no objection for the use of mobile e-wallet beyond these hazardous areas. But one must use these hazardous areas. So while visiting the petrol pump the user must check about the Zone 1 is prominently marked.

Are there any Retail benefits of using the mobile wallet for the petrol pump?

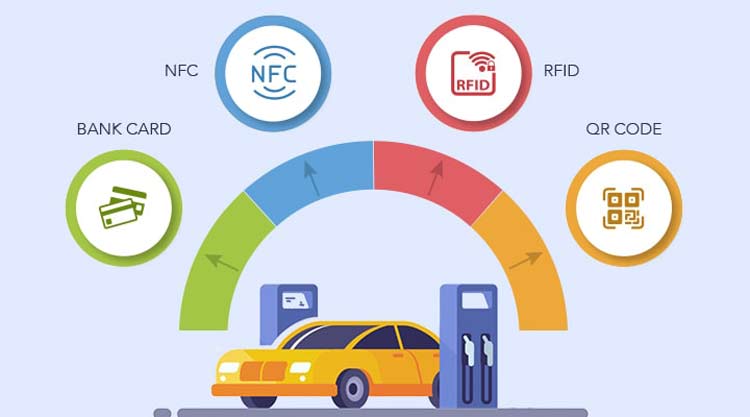

Well, the answer will be yes. There are many retail benefits of using eWallet Fuel Solutions These are as follows:

Greater relationship with the existing clients:

The digital payment done on the petrol pumps enhance the customer relationship. With the fast approach, the customer could make the payment without leaving his seat. It is convenient for the user to make the payment without carrying the cash. This leaves out a great impact on the sales and the overall business.

Retain customers:

Well, as compared to the traditional method the best method to retain your customer is online payment. The companies could introduce loyalty cards and discount offers easily. It is because with the help of an application the company could send the notification to the customer. This concept lacks in the traditional method.

Reduce cost:

The maintenance of the mobile E-wallet is of low cost. Using the e-wallet solution for fuel retailers, professionals do not have to invest more as compared to the traditional methods. The fuel stations are open for 24 hours hence there is more requirement of customers.

The traditional methods bring additional investment in this case. The mobile wallet could be a perfect solution for this. It allows retailers to continue with their operations for 24×7. This also enhances productivity.

Managing peak points efficiently:

Generally, the fuel stations experience the struggle during peak hours. The long queue of waiting vehicles could impact productivity. The situation becomes worse during a shortage of manpower. The self-checkout payment solution is good for consumers and retailers.

In such a situation the mobile app payment could be a boon. The fast and effective approach could complete the transaction with some simple tricks. This reduces the workload and allows the retailer to continue with smooth operation.

Current situation and future of cashless payment in the fuel industry:

As far as if we consider the present condition, about 72% of customers in the UK choose digital payment. They prefer to make payments at the pump instead of going to the cash counter.

About 75% of people love to purchase fuel from a specific brand if it provides reward points.

On taking this situation, it would be not wrong to say that digital payment will make its roots strong. Most of the brands will allow customers to make payment through the application.

At present ExxonMobil and Shell have launched their mobile apps. These applications allow customers to make the payment through the app. This bold step of these two brands also motivates many other fuel companies to launch their app and integrate digital payment.

Conclusion:

Payment through the mobile app or any other digital means is today’s most required factor. It is the most convenient, fast, and secure mode of payment. While using the mobile e-wallet one must take care of the zones. Digital payment is safe and beneficial for retail outlets. It could hike the business to the next level.

Hope you get useful information from this article. We would like to know your words. Kindly share your words in the below comment section.

Leave a Reply